Resilience as Currency: The Missing Valuation Metric in Modern M&A

The Blind Spots in Traditional Due Diligence

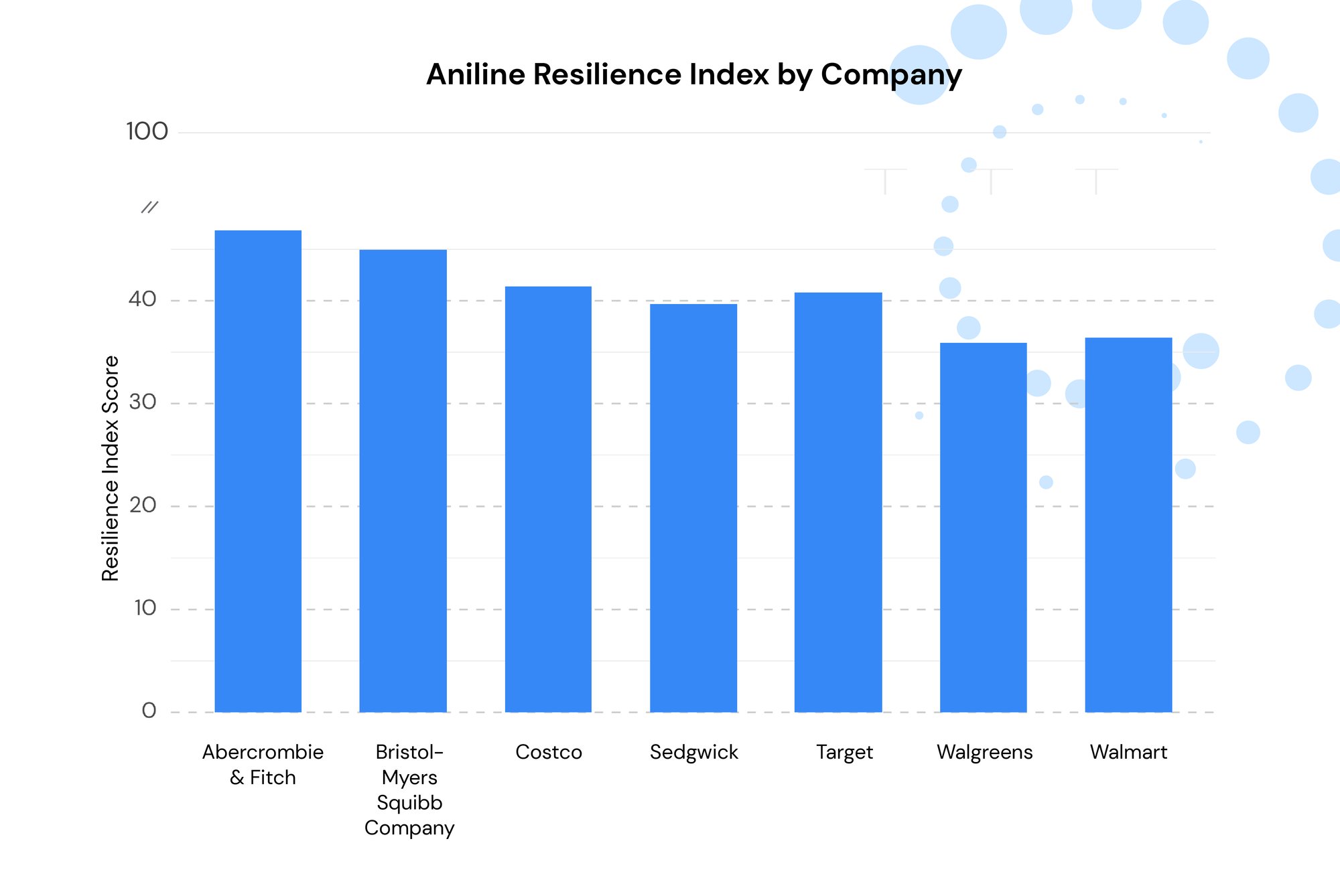

Traditional M&A due diligence follows a well-established playbook: financial audits, market analysis, operational assessments, legal reviews, and increasingly, technology evaluations. These elements remain essential, but they share a common limitation: they primarily examine static assets rather than dynamic systems. When 70-90% of mergers fail to create expected value, we must ask what critical factors are missed to explain this gap. Aniline’s Resilience Index (ARI) analysis fills the blind spot with objective scoring and deep insight. The Aniline Resilience Index Report is supported by agent to agent input from seven highly-specialized Aniline AI agents. The detailed reports generated by these specialized agents are all available individually on the Aniline platform. They are all grounded by more than 1 billion workforce perception data points.

According to research by Bain & Company, acquirers typically spend less than 10% of their due diligence resources evaluating cultural and organizational dynamics, yet these factors account for nearly 30% of integration failures. This fundamental misalignment explains why financially sound acquisitions often disappoint.

To bring these insights to life, we looked at resilience reports for several companies: Abercrombie & Fitch, Sedgwick, Bristol-Meyers Squibb, Target, Costco, Walmart, and Walgreens. Each of these cases demonstrates the importance of taking a holistic approach and dynamic approach to due diligence through the lens of resilience.

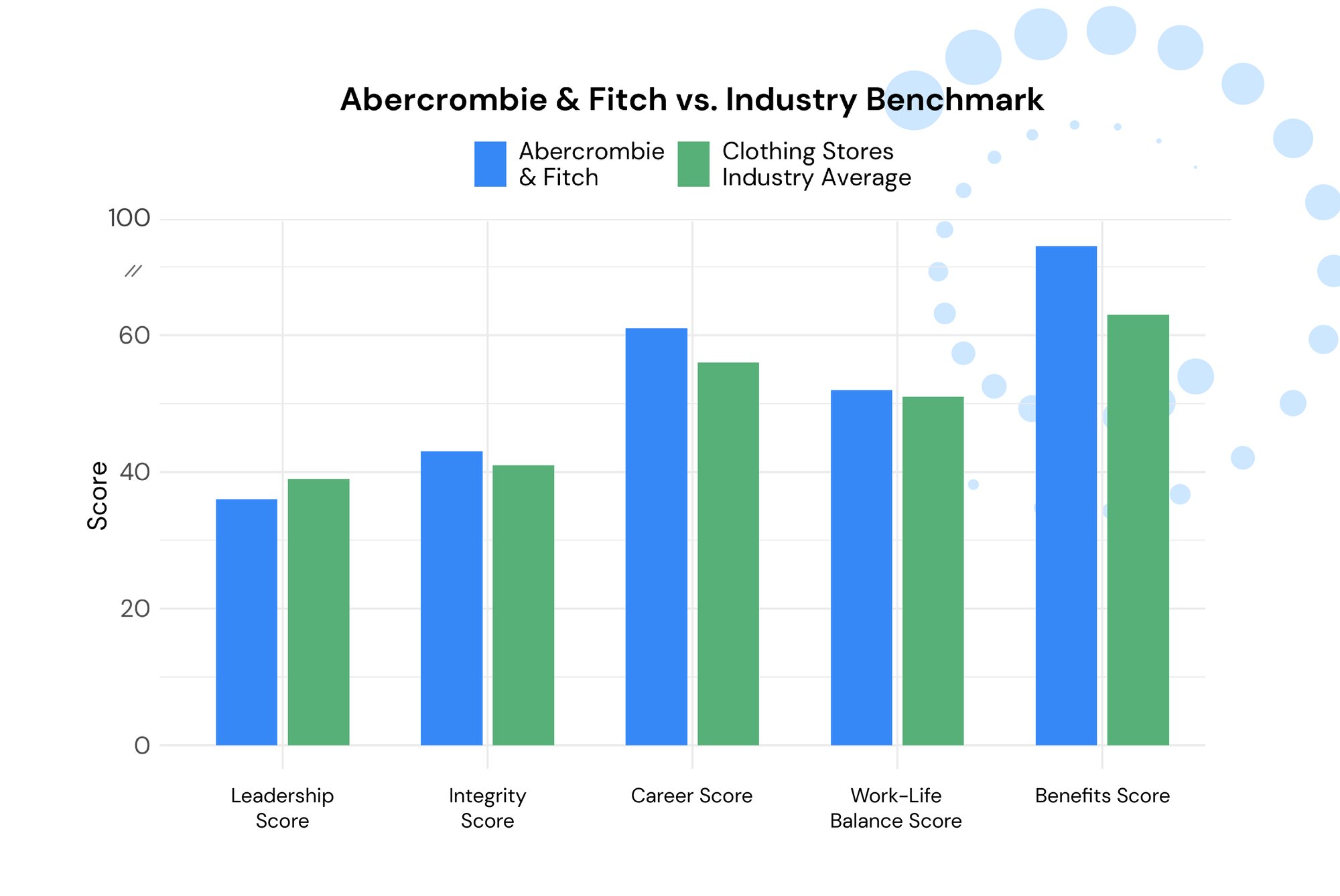

The case of Abercrombie & Fitch highlights the central disconnect perfectly. Despite an overall resilience score of 49/100, the company maintained attractive benefits (73/100, 87th percentile) and career opportunities (61/100, 80th percentile) that would appear positive in traditional due diligence. However, its leadership inconsistencies (36/100, 43rd percentile) and integrity gaps (43/100, 56th percentile) represent hidden vulnerabilities that would severely undermine integration efforts.

The High Cost of Overlooking Resilience

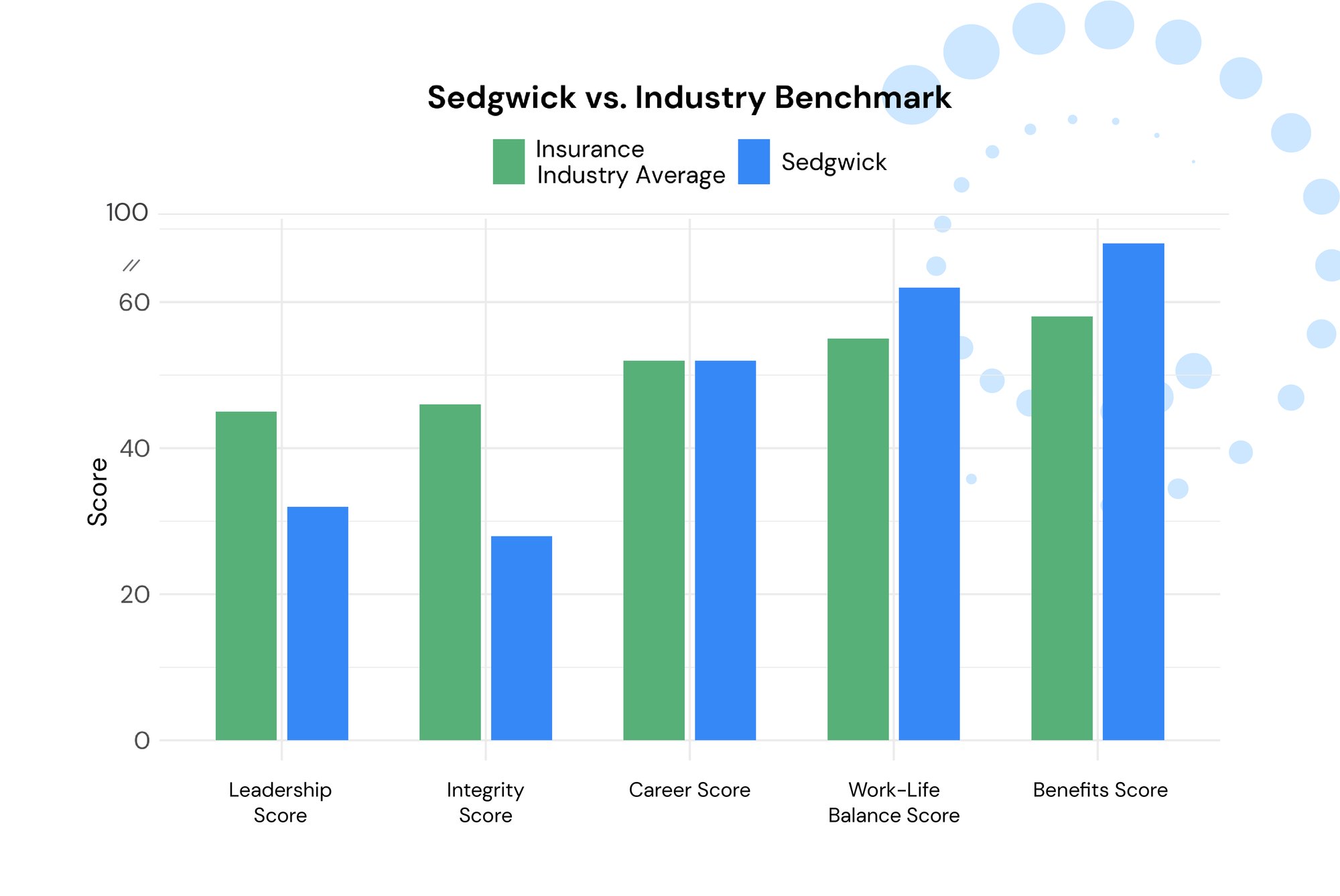

The Sedgwick resilience analysis reveals how deceptive traditional metrics can be. The company scored a concerning 44/100 in overall resilience (up from 43/100, +2.33% change) despite "flexible remote arrangements, generous PTO policies, and collaborative team dynamics." Beneath these surface strengths, their Leadership score (32/100, 8th percentile) and Integrity score (28/100, 3rd percentile) expose "inconsistent management practices, communication breakdowns, and perceived favoritism" that would severely impair integration.

These resilience deficits manifest as specific, measurable costs during integration:

- Extended integration timelines: McKinsey research shows organizations with low resilience scores take 40-60% longer to complete integration milestones

- Talent flight: Low-resilience organizations experience 2.5x higher executive turnover during the first year post-acquisition

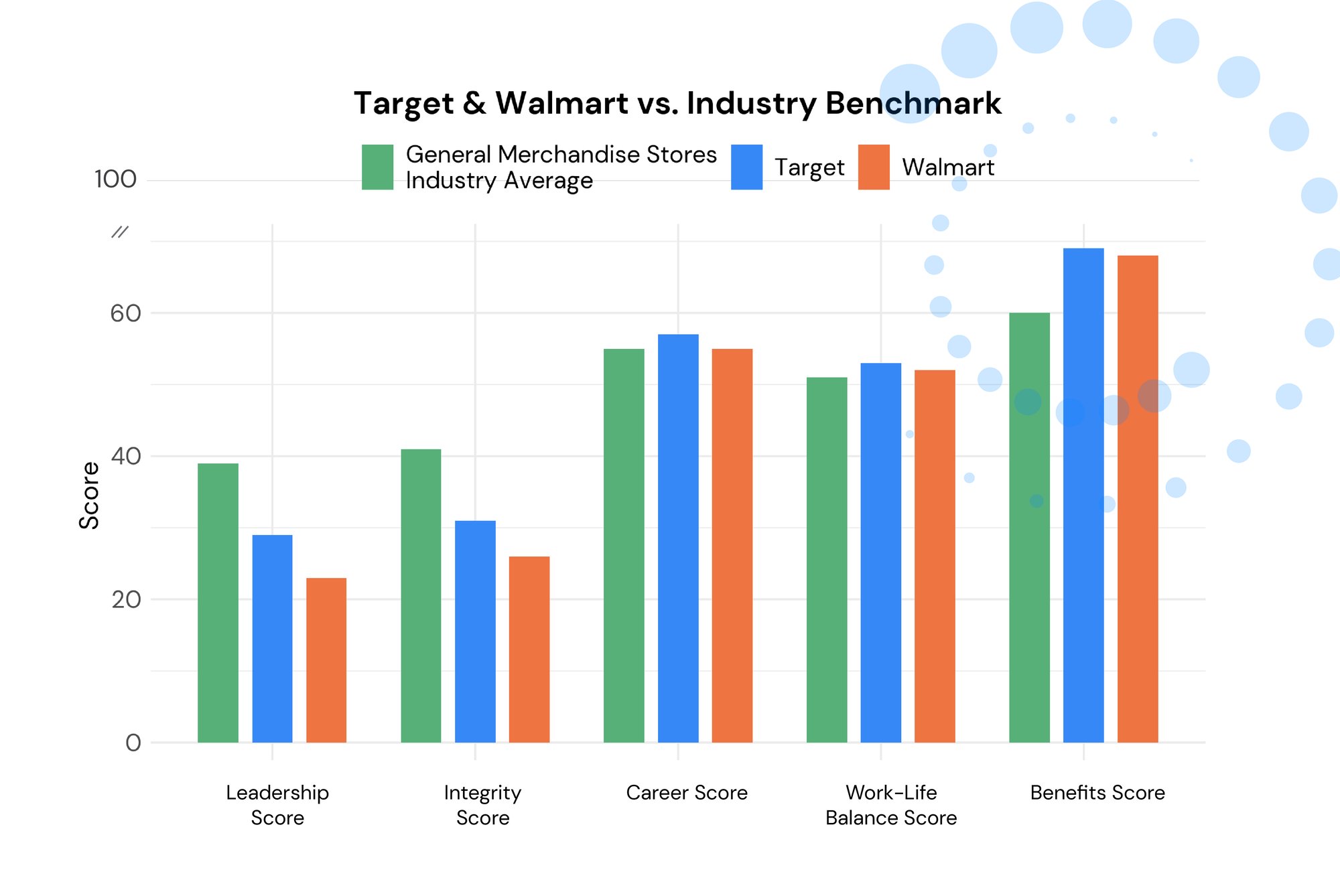

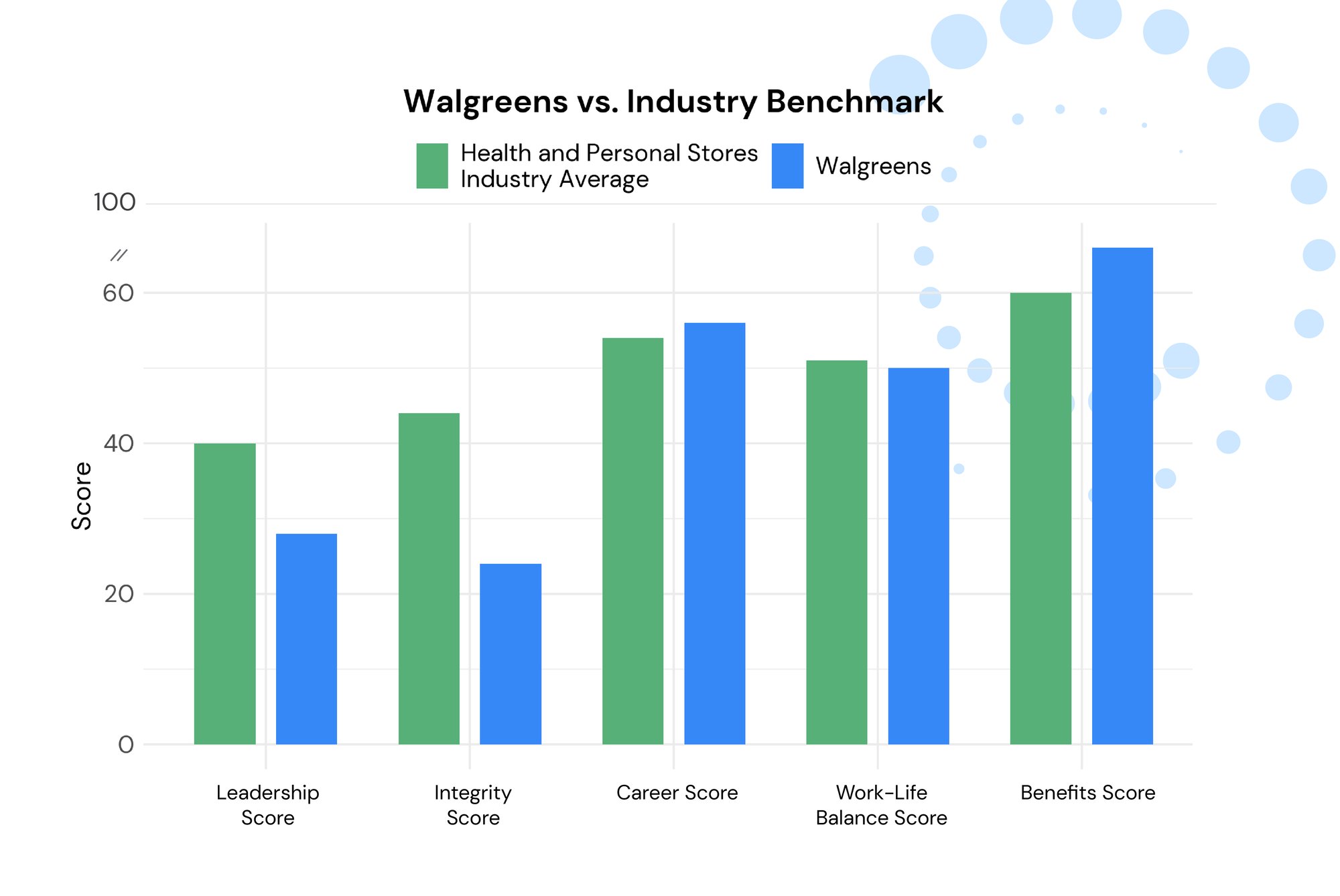

- Synergy delays: Companies with leadership resilience scores below 40/100 (Walmart: 23/100, 5th percentile; Target: 29/100, 16th percentile; Walgreens: 28/100, 13th percentile) achieve only 60% of projected synergies within planned timeframes

- Cultural erosion: When integrity scores fall below 40/100 (Walmart: 26/100, 6th percentile; Target: 31/100, 20th percentile; Walgreens: 24/100, 4th percentile; Sedgwick: 28/100, 3rd percentile), employee engagement typically drops 20-30% during integration.

What Resilience Diligence Reveals That Traditional Methods Miss

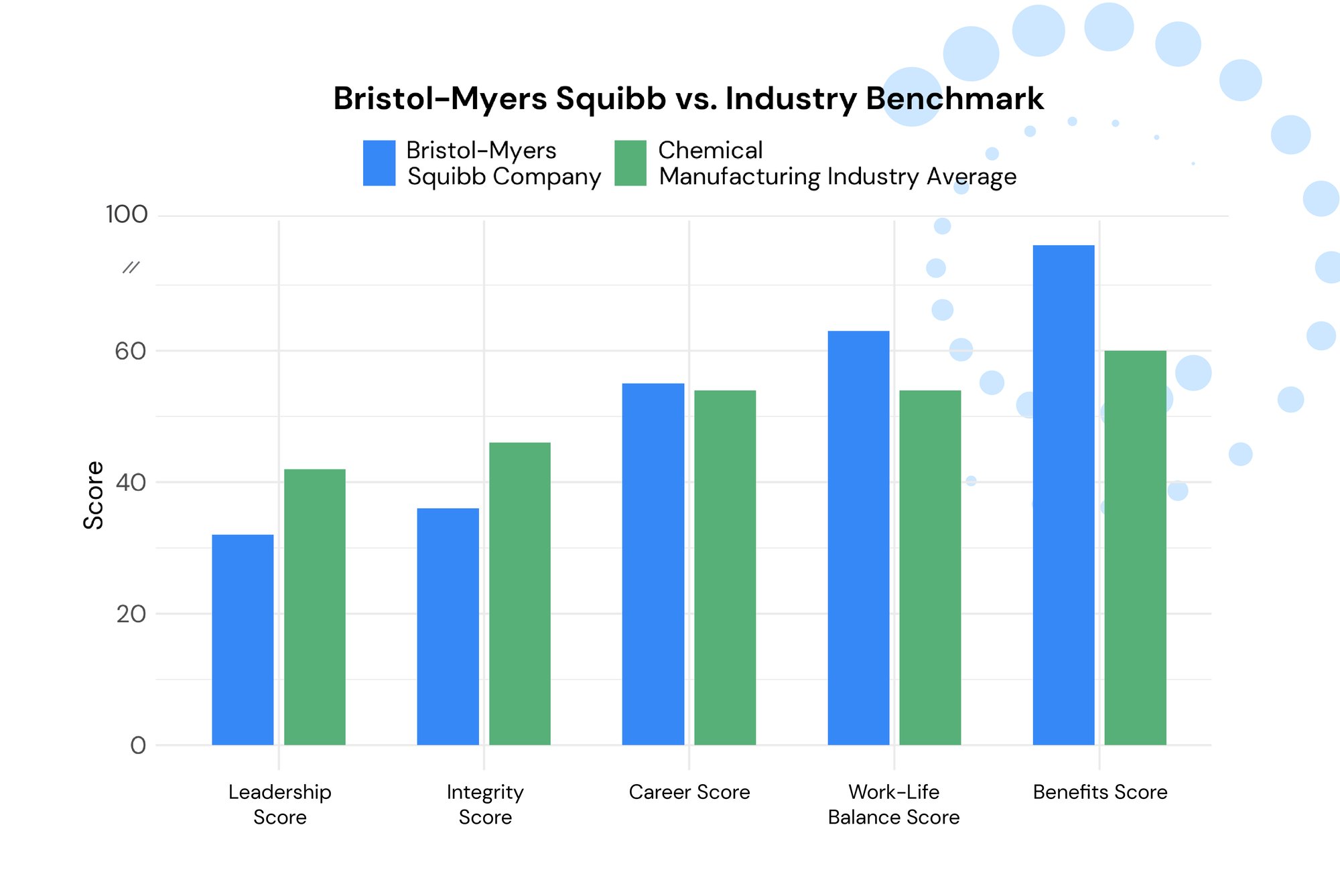

Bristol-Myers Squibb's resilience analysis demonstrates why examining resilience dimensions is so crucial. Despite "structured onboarding, mentorship initiatives, and targeted training modules" that might impress traditional evaluators, the company's leadership approach was found to be "predominantly top-down with decisions often made in isolated 'back rooms' with minimal input from non-senior employees." This leadership model creates fundamental obstacles to the rapid adaptation required during integration.

Resilience diligence specifically evaluates:

- Adaptive capacity: How quickly can the organization pivot when faced with new leadership, priorities, and processes?

- Trust infrastructure: Do employees trust leadership enough to follow them through disruptive change?

- Communication effectiveness: Can critical information flow quickly and accurately throughout the organization?

- Stress tolerance: Can the workforce absorb additional demands without breaking?

- Leadership consistency: Do management practices create predictability that stabilizes operations during transition?

Implementing Resilience Diligence in Practice

Target's resilience report (46/100, down from 47/100, -2.13% change) reveals exactly how these assessments work in practice. The analysis identified that "leadership is predominantly top-down and metrics-driven" with "mixed messages and frequent policy changes without adequate explanation or support." These findings would enable an acquirer to develop specific integration plans addressing communication gaps and leadership standardization rather than discovering these issues mid-integration.

Leading organizations now incorporate resilience assessment through:

- Comprehensive resilience scoring: Quantitative measurement across multiple dimensions creates comparable metrics that inform go/no-go decisions

- Multi-level stakeholder interviews: Gathering perspectives from executives, middle management, and frontline employees reveals alignment gaps

- Cross-organizational communication mapping: Analyzing information flow patterns identifies potential integration bottlenecks

- Stress-testing scenarios: Simulating integration challenges to evaluate adaptive capacity

- Integration readiness assessments: Evaluating specific capabilities required for successful combinations

The Evolution of Due Diligence

Walmart's resilience analysis (43/100, unchanged, +0% change) demonstrates why resilience diligence must become standard practice. Despite market leadership, the company displayed "inconsistent management practices, communication gaps, and perceived favoritism" that would create "significant vulnerabilities that would challenge its ability to respond effectively to shock events" including the substantial disruption of integration. The company shows particularly concerning scores in Leadership (23/100, 5th percentile), Integrity (26/100, 6th percentile), and DE&I (26/100, 3rd percentile).

Forward-thinking acquirers are now incorporating resilience diligence alongside traditional evaluations by:

- Adding organizational psychologists to due diligence teams

- Conducting anonymous employee pulse surveys in target companies

- Running simulated integration workshops with leadership teams

- Mapping decision-making processes across both organizations

- Evaluating previous change management successes and failures

Dimensions Demanding Attention

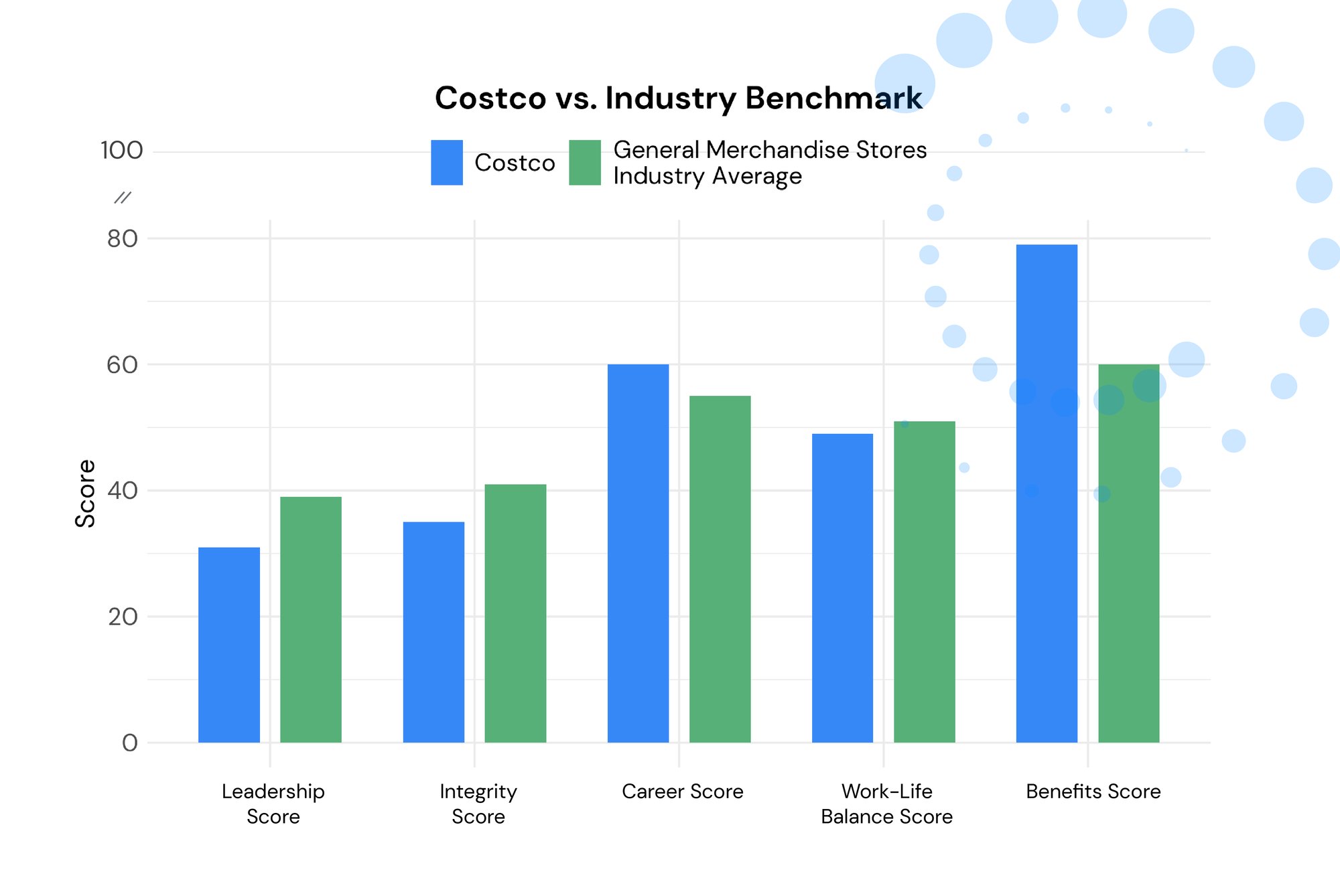

Costco Wholesale's resilience assessment (49/100, unchanged, +0% change) demonstrates why examining multiple resilience dimensions matters. Though the company scored well in Benefits (79/100, 99th percentile) and Compensation (69/100, 98th percentile), its Leadership score (31/100, 23rd percentile) revealed "centralized, top-down decision-making processes" where employees report leadership "lacks a unified direction" and exhibits "differing expectations across teams" that would create confusion during integration. The company also shows concerning scores in Integrity (35/100, 32nd percentile) and DE&I (34/100, 13th percentile).

The five critical resilience dimensions requiring assessment include:

- Leadership (30% weight): Consistency, communication clarity, decision-making processes, and change management capabilities

- Integrity (25% weight): Alignment between stated values and actual practices, trust levels, and accountability systems

- Workplace (20% weight): Collaborative dynamics, resource adequacy, cross-functional coordination, and psychological safety

- Work-Life Balance (15% weight): Formal flexibility policies, implementation consistency, and work intensity

- Career Development (10% weight): Advancement transparency, skill development, and knowledge transfer mechanisms

Conclusion: The Resilience Imperative

Walgreens' concerning resilience score (42/100, up from 41/100, +2.44% change) highlights why resilience diligence is no longer optional. Despite "career development opportunities, flexible scheduling, and pockets of supportive team cultures," the company's significant vulnerabilities in Leadership (28/100, 13th percentile) and Integrity (24/100, 4th percentile) would create fundamental barriers to successful integration. Without resilience assessment, these critical weaknesses would remain hidden until they emerged during integration—when addressing them becomes exponentially more difficult and costly. The company also shows concerning scores in DE&I (27/100, 1st percentile) and Workplace (42/100, 7th percentile).

For M&A professionals, incorporating resilience diligence into standard practice isn't merely adding another checkbox to due diligence—it's recognizing that in today's complex business environment, an organization's ability to adapt, absorb, and transform through disruption is as fundamental to valuation as its balance sheet. The Aniline Resilience Index offers precisely this critical dimension, providing quantifiable insights that can mean the difference between a transformation that creates lasting value and one that joins the long list of disappointing deals.

Curious About a Company's Resilience Score?

Which organization would you like to see analyzed with our Aniline Resilience Index? We're continuously expanding our database and prioritizing companies our readers care about most.

Request a Company’s Resilience Score →

.png?width=4334&height=1355&name=Logo%20with%20name_Blue+Yellow%20(1).png)